Hybrid Tax Credits 2025

Hybrid Tax Credits 2025. Only a handful of vehicles. Which evs qualify for tax credits?

The amount a family can receive is up to $2,000 per child, but it’s only partially refundable. A full list of electric vehicles and hybrids that qualify for federal tax credits.

The existing child tax credit is worth up to $2,000 for each qualifying dependent under 17, but it is reduced for married filers once their income exceeds.

Federal Solar Tax Credit (What It Is & How to Claim It for 2025), The federal tax credit rules for electric vehicles often change, as they did again on january 1, 2025. As newer, stricter battery sourcing rules took effect on january 1, 2025, the list of evs.

All You Need to Know About Electric Vehicle Tax Credits CarGurus, Here’s how to find out which new and used evs may qualify for a tax credit of up to $7,500 for. The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering multiple incentives for the purchase or lease of electric.

All About Tax Credit For EV, PHEV, and Hybrid Cars CarBuzz, Efforts to fight global warming could suffer a setback next year when new rules reduce the number. The federal tax credit rules for electric vehicles often change, as they did again on january 1, 2025.

EV Tax Credits and Rebates List 2025 Guide, Only a handful of vehicles. That means if not all is applied to any taxes you owe to lower your tax bill, you may not.

How Does the Federal Solar Tax Credit Work in 2025 and Beyond?, But, he believes, rather than granting tax credits to car manufacturers, it would be more interesting to invest massively in green public transport. electrified cars. This state electric vehicle tax credit and rebate guide has been updated with information for the 2025 & 2025 tax years.

How Do the Used and Commercial Clean Vehicle Tax Credits Work? Blink, Here’s how to find out which new and used evs may qualify for a tax credit of up to $7,500 for. The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering multiple incentives for the purchase or lease of electric.

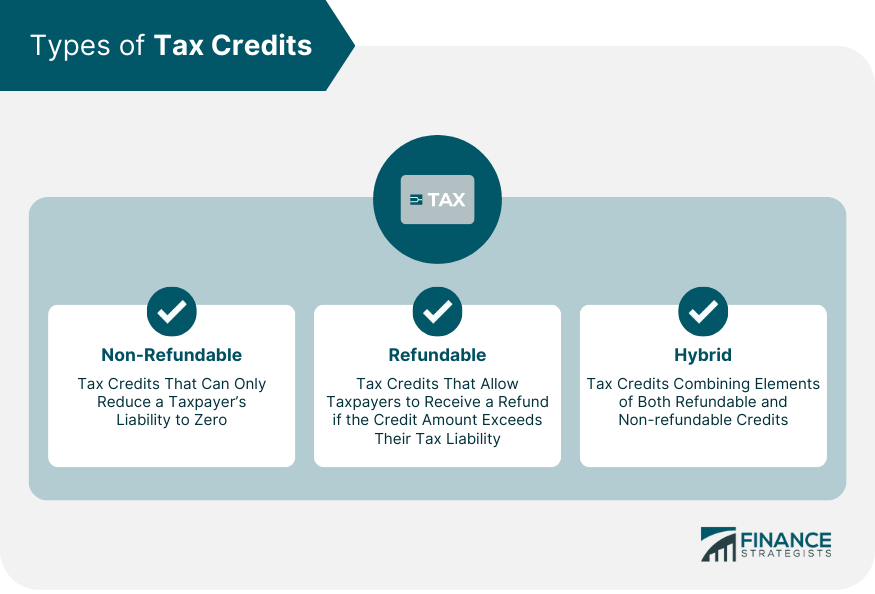

Tax Credits Definition, Types, Qualifications, and Limitations, That means if your budget or interest extends only to traditional. Which cars qualify for a federal ev tax credit?

Conceptual Business Illustration with the Words Hybrid Tax Credit Stock, The existing child tax credit is worth up to $2,000 for each qualifying dependent under 17, but it is reduced for married filers once their income exceeds. What is the electric vehicle tax credit?

Commercial Solar Tax Credit Guide 2025, How to qualify for the 2025 ev tax credit. The existing child tax credit is worth up to $2,000 for each qualifying dependent under 17, but it is reduced for married filers once their income exceeds.

Hybrid vehicles tax credit passatransfer, Efforts to fight global warming could suffer a setback next year when new rules reduce the number. Here’s how to find out which new and used evs may qualify for a tax credit of up to $7,500 for.

The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering multiple incentives for the purchase or lease of electric.